NEWS

ACC Announces Updates to Help NZ Businesses

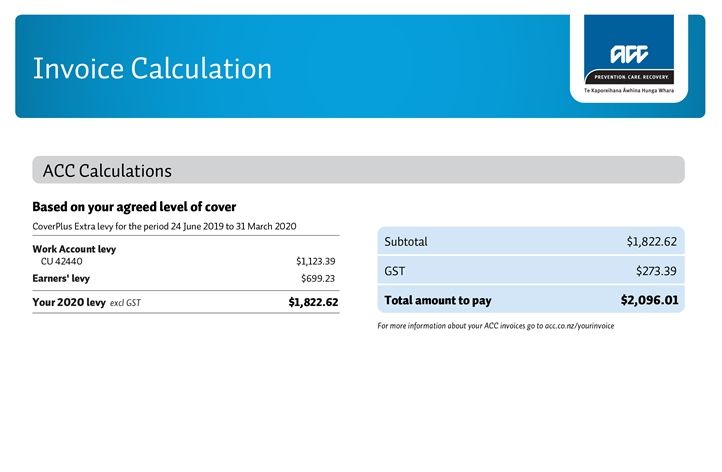

ACC has recently announced some changes to specifically support New Zealand businesses through these challenging times. From a dedicated support page to delayed invoicing and other online help. We cover it here...

In addition to a dedicated new website page which contains helpful information about invoicing this year, ACC has delayed its annual invoicing to October and November instead of the usual July statement date.

Following is the ACC announcement...

Released 20/08/2020

From October, we will be sending out annual invoices which would have normally been sent in July.

Our CoverPlus Extra invoices that were normally sent in April, were sent from July.

We decided to delay these invoices for three months to help relieve the immediate financial impact felt by many businesses earlier this year due to COVID-19. However, we also realise that the financial impact may only just be reaching other businesses.

We want to provide our customers with some guidance on what to expect and assure everyone we are here to support them manage their invoice payments.

The timeline and information we've set out below is our current invoicing plan. There are still many uncertainties for New Zealand businesses, and because of that we remain committed to supporting businesses where possible and will continue to review our plan in line with any significant nationwide changes due to COVID-19.

The most up to date information about our response and how we can assist, is on our website.

COVID-19 information for businesses

Ensuring the impact of COVID-19 is reflected in your 2020/21 provisional invoice

From now until the end of September we are asking that all employers who believe their 2020/21 liable payroll will be reduced due to COVID-19 provide us with an estimate to use for your provisional invoice. This will help us ensure your invoice is as accurate as possible.

If for any reason your final liable payroll (year ending 31 March 2021) is different to your estimate, this will be reflected when the final invoice is issued in 2021.

There are two ways to provide us with a revised liable payroll estimate:

- If you're an employer with PAYE staff, register or log in to MyACC for Business

- If you're a non-PAYE shareholder, email us at business@acc.co.nz, or contact our Business Customer Contact Centre on 0800 222776.

Note. This isn't applicable for self-employed as they don't have provisional invoices.

Update your liable payroll through MyACC for Business

Disclaimer

This information is intended to provide general advice only. We recommend you discuss your specific situation with your Accountant.