NEWS

Tony Alexander - Weeding Out and Your New Strategy

I’ve written quite a bit in the Housing Markets section this week, and have more to write next week, so will keep the first section fairly short this time around.

We’re in the midst of a unique period in our history. We’re almost all on home detention for a period of between 4-8 weeks after which we will presumably be virus free and will stay that way as long as quarantine procedures at our border entry points are strong.

As we wait for this period to arrive, we have, for all intents and purposes, no economy by any normal definition of the word. It’s pointless listening to anyone trying to make an estimate of how much this will cause our GDP to fall or how high our unemployment rate will go, or what scary period in the past this looks like. Why scare the bejeebers out of people already going through a massively uncertain period which will destroy thousands of businesses and leave tens of thousands of people unemployed on top of the near 110,000 in that position at the end of last year?

We know that our entire inbound tourism sector is gone and it probably won’t start coming back until next year. This is because the poor management of the virus outbreak overseas, and inability to manage it in some under-developed parts of the world, mean the concept of free-flowing global travel won’t be relevant until a vaccine becomes available.

We know large parts of the domestic travel sector will be lost because of recent social distancing rules and the likelihood that once we emerge from our homes some version of these rules will remain in place for a while as a precaution.

We know many small businesses in the hospitality sector will never reopen. The sector is extremely competitive, is filled with people following their customer-service dreams in often under-capitalised positions, and with high set-up costs which make newer operators highly vulnerable to anything which curtails expected customer numbers in the first year.

We also know (at least you should) something which has been the focus of my presentations and discussions for at least the past two years. In pre-virus words it went like this.

Many people have done very well since 2014 as a result of the booms in construction, inbound tourism, and net migration. But as these booms either reverse or just flatten out, some poorly run operators with too much debt and too much focus on achieving more and more growth will get weeded out.

There will be weeding out also of businesses unable to quickly enough adjust to the loss of pricing power (ability to maintain margins) because all customers can now easily find alternatives online.

More weeding out will be inflicted upon those not quickly realising that the banking supercycle ended in 2008 and financing expansion through credit growth will just get harder and harder as banks build their capital bases and reduce their risk profiles.

Weeding out will be forced on some businesses if they do not quickly enough adapt what they do to reflect societal concerns about issues like global warming and use of plastics.

And others will be weeded out through excessive reliance upon a steady flow of new staff coming through with the skill and motivation levels they need. That factor will be less troublesome now.

All of the weeding out I expected to take place over this year through to 2022 is likely to occur largely in 2020. A key driver for this is not going to just be the absence of demand for now and the structural reduction in sales from earlier levels when we re-engage with each other face to face in 4-8 weeks’ time.

If you’ve got any sense, you’ll hopefully have realised that these next 4-8 weeks will be the best opportunity for you to work “on” your business rather than “in” it that you’ve ever seen. Scope exists for massive changes in what we do, how we do it, and who we do it to or for.

This can be the mother of all strategic planning sessions if you take the time to slow down and realise the unasked-for opportunity with which you have been presented.

Front-Loaded Job Losses

No two economic shocks are the same – that has been the message I’ve tried to get across here last week and in the #2 Supplement. I’ve concentrated on noting the things which were there ahead of the 1987 crash and the GFC which are not present this time around.

Such things include removal of subsidy and tariff support for manufacturing and farming, high interest rates to fight inflation, high oil prices, a high NZ dollar, collapsed export prices.

Now let’s have a look at one aspect of this downturn possibly not ever seen before in our living memory. As a rule, the labour market changes with a lag. That is, growth slows, businesses wait to see how serious things might get, then they act and lay people off. When growth accelerates businesses wait to see if the upturn will be sustained, then they start hiring again in droves. This downturn is different.

There is no waiting needed to see what is happening with the inbound tourism sector. It has gone. Layoffs will occur immediately. No lag. In the hospitality sector while some layoffs have clearly already occurred, what happens from here depends mainly on how quickly we return to cafes, restaurants, bars etc. once the lockdown ends. If social distancing rules stay in place then layoffs will continue apace. But if we can go back to our old ways then job losses may largely be confined to those newer businesses who have simply lost too much revenue to remain viable.

The chances are we will not return to where we were even without any new distancing rules. So widespread closures and job losses concentrated in the two months after the lockdown ends are likely.

Further behind in the layoff cycle will be businesses in general not directly exposed to inbound travel or hospitality. Behaviour there is likely to more closely resemble the usual pattern, but probably with some acceleration because of the nature of this shock and what is happening in other sectors.

The employment shock of this downturn will be front-loaded. That is why the greatest period of decline in our economy is likely to be over the next 3-6 months rather than spread out over the full year or 18 months.

Regular readers might recall what I wrote in my last Tony’s View for 2019.

“My outlook is positive and has been for quite some time now. (Not blindly so. I’m rereading “The Day The Bubble Burst” this week, a Depression classic by Gordon Thomas and Max Morgan-Witts.)”

Four things. First, no, I did not expect this downturn – though I’ve held no equities for some years in expectation of a significant correction. Second, this is not a repeat of the Great Depression because the timeline is shorter than back then when it took four years for things to start recovering over 1934-36 after a 45% decline in export prices. The NZ and world economies were on the way back up before Labour were elected to office in 1935.

https://www.rbnz.govt.nz/-/media/reservebank/files...

Third, the book you do want to read if you’re after insight into the impact of the Great Depression is The Sugarbag Years by Tony Simpson.

Fourth, the Great Depression was not caused by the crash in share prices but the bad policy responses afterward. Since then downturns have generally led to governments running budget deficits rather than trying to achieve surpluses, and central banks boosting money supply rather than cutting it, and supporting banks rather than letting them fail as half did in the US in the 1930s.

NEW ZEALAND'S HOUSING MARKET

Our housing markets are going to go on hold for the remainder of this year as we wait out the virus. Buyers will clearly pull back because of income concerns. But how many sellers are likely to come forward trying to sell their property because they have to?

That is the true crux of the matter and in that regard, there are numerous forces in play. The two normal big ones are interest rates and incomes.

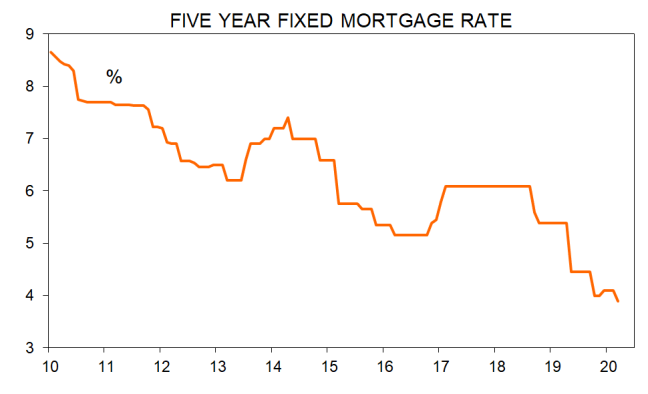

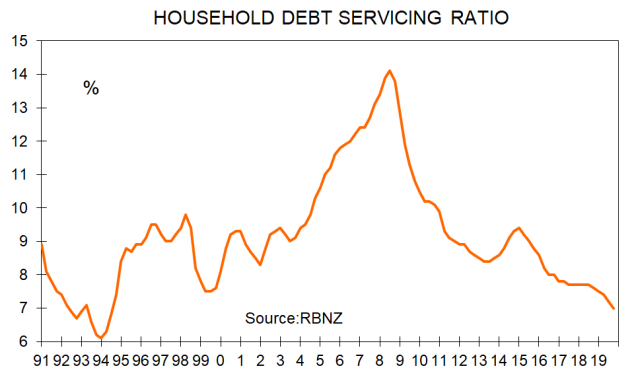

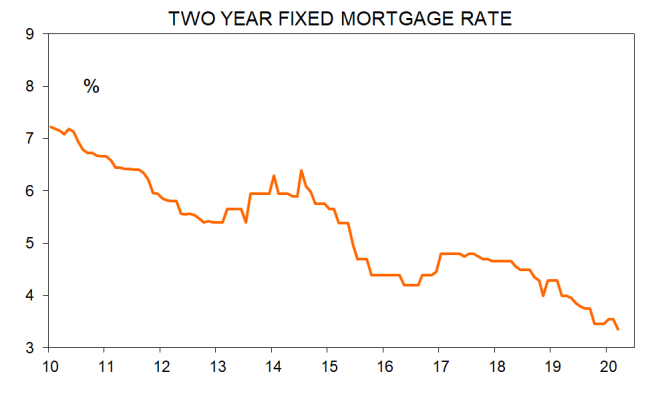

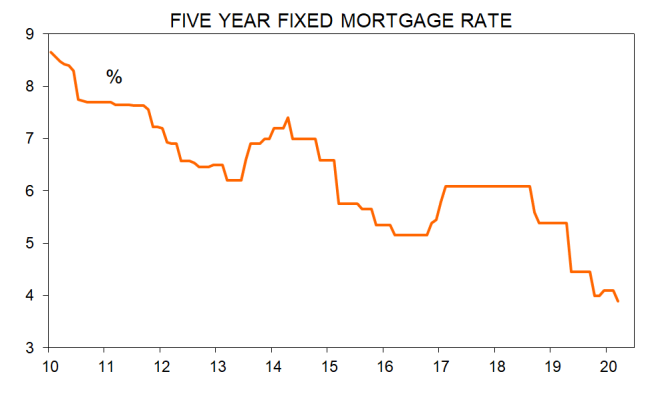

Mortgage rates were already at record lows before the Covid-19 crisis and now they are lower. Debt servicing as a proportion of household income late last year was at its lowest since 1994 at just 7% from 14% heading into the GFC when average house prices fell 9% on an annual average basis nationwide.

Servicing a mortgage is not going to be much of a problem on average for those with a job, especially given the application of LVRs in recent years, and banks applying test interest rates 3-4% above actual borrowing costs.

This has not been a downturn preceded by a debt binge. Here are some numbers showing that. In the ten years to 1999 household debt grew by 220%. In the ten years to 2009 it grew 140%. In the past ten years growth has been 60%. In fact, in just the past five years growth has been 41% versus 84% in the five years leading int the GFC.

But what about income? We have no way of knowing how much household income is going to fall as a result of the virus crisis. Job losses risk being extreme because of the labour-intensive nature of the travel and hospitality sectors.

But there are strong factors working against big forced selling.

1. Virus Eradication

This economic decline will be just temporary. The virus will eventually be brought under control one way or the other, with the worst time-frame being 16 months from now allowing for the 18-month vaccine-development timeframe cited by the scientists and the fact they’ve been working on it for at least two months now.

2. Mortgage Holidays

The Reserve Bank and banks have agreed on allowing any mortgage holder affected by the downturn to place their repayments on hold for up to six months. This is a branding opportunity which the banks cannot pass up – to rebuild reputation lost in the years after the 1987 crash.

If six months is not long enough for some people, I would imagine some extra timeframe will be given as long as there is sufficient equity in the property and a plan by the borrower to get income flowing again in the near future.

3. The Working Visa Cushion

The extent to which unemployment rises amongst home owners will be cushioned by this very large factor. A lot of the near 200,000 people working in New Zealand on temporary working visas have been employed in the labour-intensive, low paying, generally lower-skilled travel and hospitality sectors.

They do not own homes and while they in the short-term will receive a special visa extension to September, once conditions and travel networks allow, they will have to leave the country in very large numbers.

This will however have an impact on the renting sector. So too will the removal of virtually all Airbnb business for an extended period of time. Those properties will be made available for long-term rent.

Landlords can also kiss goodbye to any thoughts that lobbying might make the government substantially water down some of their proposed tenancy law changes. The six-month rents freeze probably won’t be extended as that would be too radical a move in a free market economy and history tells us that simply dries up rental supply whilst degrading stock quality.

But the automatic rolling of fixed term tenancies into periodic we can count as cemented now I’d suggest, along with the no cause tenancy termination extension to 90 days. The inability to evict until after 60 days of no rent payment versus 14 would continue beyond three or maybe six months. But reversion to 14 is not guaranteed.

The centrist-left government in place now and perhaps after September has an ideological bias against landlords. If they back off anywhere it will be with the farming sector – our new bright and shining generator of export earnings. No wait, they always have been. People just forgot that during the surge in foreign visitors clogging our housing stock, roads, tracks, airports and hospitals in recent years.

The exit, eventually, of tens of thousands of people on working visas will reduce housing pressures in our main centres. Prospects for rent rises in coming years now look different to what they were two months ago, even allowing for rising costs related to improving the housing stock. The reduced prospect of rental gains and stronger rules in favour of tenants will see more investors leave the sector. But note my sixth point below.

Note that rather than delaying the start of ring-fencing the government have allowed deduction as an expense of all capital spending below $5,000 for this year from the previous $500. This is relevant to all businesses but will also be of some cash assistance in a year’s time to property investors.

4. Why the Baby Boomers Bought

No property owner has woken up recently to find their asset is worth 30% than four weeks ago, as has happened for equity investors. The reinforcement of the lack of scary volatility in house prices will boost long-term housing demand. People will now understand the Baby Boomer preference for property following the 1987 crash. But before you Boomers look smug, you’d best recognise this. After this, you will never again be able to say that the younger generation have been molly-coddled, that they have never seen hard times, and that they lack resilience.

5. Labour Shortages & New Demand

We have entered the downturn with labour shortages in many sectors, including the primary sector. And now demand is rising for cleaners, healthcare workers, supermarket stackers, fruit pickers etc. Switching of jobs (Kiwis have preference) will mitigate pressure to sell for those making the switch.

6. Sons and Daughters for the Return Home

In 4 – 8 weeks’ time New Zealand will be virus-free apart from some people in quarantine after arriving on our shores. Apart from China and maybe one or two other Asian countries, no other country is likely to be in that position. In particular there appears to be utter disarray in top level handling of the situation in Australia and the United States.

I wish to advance a theory for which none of us can truly judge magnitude in the absence of any past similar event. Our image amongst the near one million Kiwis overseas is going to change. Our reputation as a quality food producer with strong political leadership (never thought I’d write that this term), and good lifestyle options is going to attract some Kiwis back, along with their partners and their children.

There are near 600,000 Kiwis in Australia alone.

I’m still trying to form a view around how current events will alter our recent net migration flows which have averaged 29,000 per annum over the past ten years and 45,000 in the past year. In the short-term this net flow will decline because the gross flows cannot properly function.

But once the air travel options start appearing again, I’m veering toward the view that our net migration inflows will take a structural lift. That will underpin housing demand.

7. Construction Growth Will Slow

No new houses will be built for the next 4 – 8 weeks. Lack of bank willingness or even ability to take on the risk of new projects will see the backload of current projects worked through then a decline in completion numbers from late this year.

Don’t rule out the possibility of some projects sitting uncompleted as buyers cancel contracts and new buyers hold off. It will be very difficult for a developer to convince a lender that they will get enough pre-commitments let alone off-the-plan sales in the next couple of years to allow funding promises to be made. Existing commitments by banks for projects not yet started are in fact likely to be scrapped where the contract allows – and they usually do when it comes to a bank changing its mind about willingness to finance something.

But lets now run through some negatives beyond the effects of a sharp rise in unemployment.

1. Wrong Kiwisaver Fund

If you’re not going to use your Kiwisaver fund to finance a house deposit you opt for the Growth option. If you are going to use it to buy a house, at most you choose the balanced option but you should really stick with the conservative choice. Many young people planning to buy their first home have not done that. They may have to put their ownership plans on hold for a year.

2. Non-Bank Lenders

A number of Australian non-bank lenders have been engaging in strong expansion plans in New Zealand in recent months. They are now pulling back and that means fewer options for borrowers.

3. Bank Lending

All stops are being pulled out to ensure our NZ banks can carry as many of their personal and business clients as possible through to the recovery. The Reserve Bank have delayed the planned increase in capital bases by a year. They are allowing banks to fund lending with less “sticky” deposits than before – seen as the Core Funding Ratio being allowed to slip as low as 50% from the required 75% which has been comfortably exceeded by banks anyway. Special lines of credit have been made available and the quantitative easing programme will provide extra funds for lending.

But there are three very important points to note. First, I’ve written before about the ending of a bank supercycle in 2008 which started in the mid-1980s. Lending growth has been slow in recent years and even without Covid-19 was set to remain slow. I invited businesses to plan their growth around less bank credit availability than in the past decade. That track of tightening remains in place.

Second, once things settle down and our economy is at a new equilibrium sometime next year, extra restrictions on bank lending are going to be focussed on to better prepare our financial system for the next crisis. 10-12 years is the cycle length it seems – the amplitude is a bugger this time around.

Third, banks are focussing all their attention and staff resources on carrying new customers through. They will have no strong interest in taking on new clients now. That applies particularly to new business loan applicants but also new mortgage enquiries.

4. Bias Toward Tenants

Low interest rates and extreme volatility in alternative investments may well encourage most property investors to stay in the market. But our government has a bias against landlords and they will try as best as possible to use the Covid-19 window of opportunity to lock in place institutionalised arrangements in favour of tenants to the cost of landlords. This will encourage more investors to sell and make new investors wary.

5. Airbnb

Properties which were removed from the rental pool and not available for purchase because of Airbnb holiday letting opportunities will now flood back into the rental market. Some will be put up for sale.

The outcome of all of these many new developments is difficult to figure out. Maybe I’ll try a survey in coming weeks to get a feel. For now, I think it is easy to predict that house prices will fall in tourism hotspots. Their structural underpinning of inbound visitors has gone and will not rebuild to old numbers hopefully forever (for those of us who value the planet and our serenity here in Godzone).

In the regions price declines generally are likely as people seeking work head to the cities, investors realise they have over-invested, some over-building and excess development of sections will become apparent in some locations (again), and drought hits some areas.

In the main centres small price falls are likely this coming year. But no-one panicked when Auckland prices fell 4.5% over 2016-19 so its neither here nor there in the big scheme of things relevant to anyone holding or considering purchasing a property if prices show some decent movement this year.

I have a lot more thoughts to write here with regard to how what we are learning during our lockdowns may influence our property choices in the future. But I shall save them for another time. Some might appear before then in the daily column I now write for the Stuff website, or the fortnightly column I write for the Sunday Star-Times, or on the webinars I am doing for investment-type organisations now.

Interest Rates – Will They Rise or Fall?

They’re going nowhere for years. The OCR which mainly affects 90-day bank bill yields which mainly affect floating mortgage rates will be at 0.25% for the next 12 months the Governor has told us. It will probably still be there in 2-3 years.

Medium to long-term fixed rates will change slightly as global conditions alter. Where rates sit now is probably as low as they are going to go barring a bank pushing a special in order to gain market share. That is not highly probable given the lack of any new lending opportunities in the next few weeks because the real estate market is closed. Then when it opens banks will maintain a staff resource focus on servicing existing clients rather than finding new ones.

CHOOSING YOUR FIXED MORTGAGE RATE TERM

There have been no new minimum interest rates introduced this week so the calculations below are unchanged.

When fixing a mortgage rate term most people take whichever rate is the lowest. So, each week I shall calculate what rates would have to be in the future to make this option better than some alternatives. Note, there are far, far more alternatives than calculated here. And always remember, it is worth paying a premium for rate certainty over a longer period of time. It’s also worth using a broker to get the best deal. Broker use is far higher in Australia than New Zealand but we will probably catch up.

Current minimum fixed rates across the main banks. *

1 year - 3.05%

2 years - 3.35%

3 years - 3.65%

4 years - 3.79%

5 years - 3.89%

I can fix 1 year at 3.05%.

Is this better than fixing 2 years? - Yes, if in 1 year the 1-year rate is below 3.65%.

Is this better than fixing 3 years? - Yes, if in 1 year the 2-year rate is below 3.95%.

Is this better than fixing 4 years? - Yes, if in 1 year the 3-year rate is below 4.04%

Is this better than fixing 5 years? - Yes, if in 1 year the 4-year rate is below 4.10%.

Is it likely that in one year’s time the one-year fixed rate will be above 3.65%? No. So if two years was as far out as I was looking, I would personally opt to fix one year currently. In a year’s time what are the chances that the two-year rate is above 3.95%. Again, not strong. So, I again would fix one year then look to fix two years one year from now if a three-year exposure was my preference. We Kiwis tend to fix at whatever the lowest rate is, and the balance of probabilities suggests doing just that currently will yield the lowest debt cost for the next few years. However, I personally am a conservative borrower. If someone were to offer me a three-year fixed rate at 3.3%, I’d probably take it.

*Minimum 20% deposit, owner occupiers, 6 largest lenders.

Compounding is minor so is ignored.

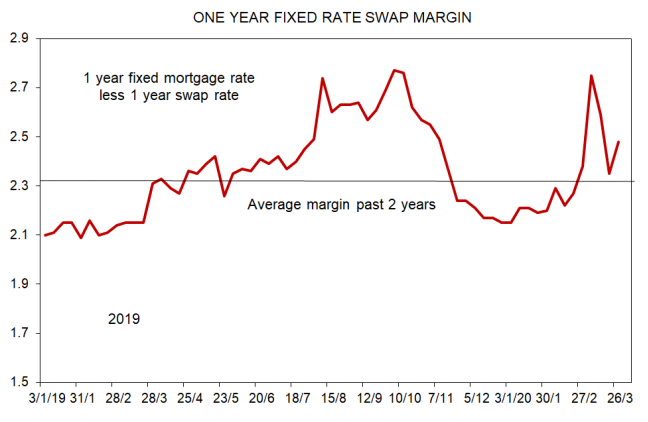

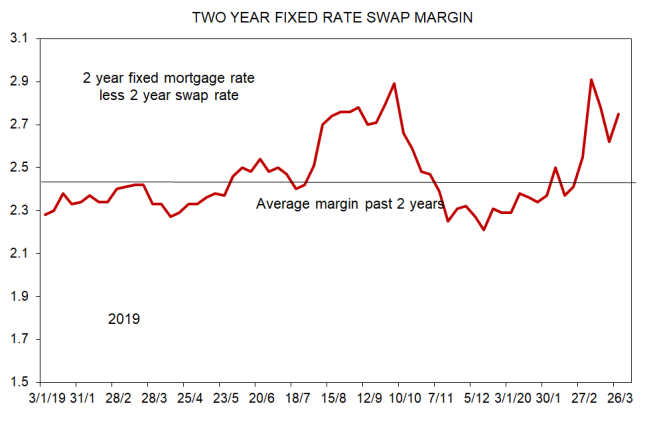

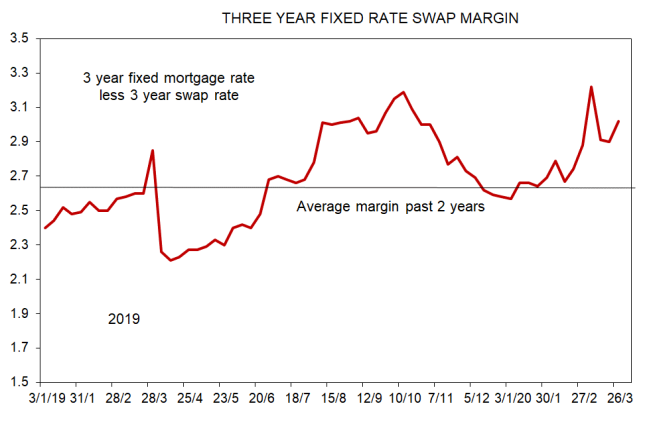

IS A FIXED RATE CHANGE IMMINENT?

I do not believe so. Bank non-swap rate funding costs have risen in this new uncertain global credit risk environment. In a visual sense that would mean the most recent data points in the red lines in the four graphs below are actually a lot lower than shown. The extent to which margins are above average for the 1-3-year terms is a lot less than implied here. That, taken in conjunction with banks pulling back from attracting new business, and past instances of margins staying well above average for extended periods, says to me further rate cuts from current levels are not very likely. Since 2009, every single time we economists have said that we think this is as low as rates are going to go, we have been wrong. This time the chances are very high we’ll be right. Surely.

You can form your own opinion as to whether banks might be about to raise or lower their fixed rates by looking at the following graphs. They compare published fixed rates with the most frequently changing component of the total cost of funds – the swap rate. Note that there are other funding costs which will not be captured here, but they change infrequently. But be warned. There is no real forecasting insight delivered by a thing (equity, exchange rate etc.) moving further from some concept of fair value or average. If a thing is 10% above trend, it might simply be on its way to being 40% above trend. For good bank rate comparisons access www.interest.co.nz